In the dynamic world of business, understanding key financial indicators is essential for effective decision-making. This financial concept plays an indispensable role in determining the profitability of individual items sold by a company and informs critical decisions about pricing, production quantities, and product lineups. Businesses that sell many different products can also use the contribution margin to understand which of their different products are the most profitable. Managers might decide to cut certain product lines if they produce a low marginal profit per unit sold.

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Here, we are calculating the CM on a per-unit basis, but the same values would be obtained if we had used the total figures instead. If the CM margin is too low, the current price point may need to be reconsidered. In such cases, the price of the product should be adjusted for the offering to be economically viable. Paul Boyce is an economics editor with over 10 years experience in the industry.

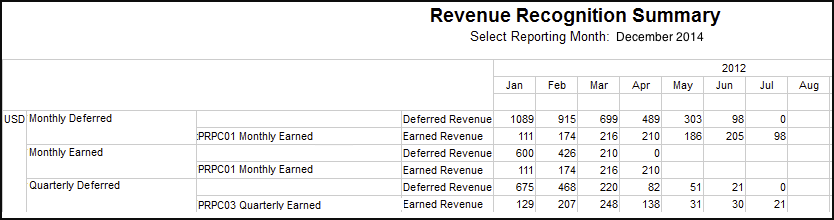

- Contribution margin (presented as a % or in absolute dollars) can be presented as the total amount, amount for each product line, amount per unit, or as a ratio or percentage of net sales.

- This means that, for every dollar of sales, after the costs that were directly related to the sales were subtracted, 34 cents remained to contribute toward paying for the indirect (fixed) costs and later for profit.

- Investors, lenders, government agencies, and regulatory bodies are interested in the total profitability of a company.

- The best contribution margin is 100%, so the closer the contribution margin is to 100%, the better.

- However, you need to fill in the forecasted units of goods to be sold in a specific future period.

- The resulting contribution dollars can be used to cover fixed costs (such as rent), and once those are covered, any excess is considered earnings.

Otherwise, the amount of expense recognized may incorrectly include costs not related to revenues, or not include costs that should be related to revenues. The contribution concept is usually referred to as contribution margin, which is the residual amount divided by revenues. It is easier to evaluate contribution on a percentage basis, to see if there are changes in the proportion of contribution to revenues over time.

When allocating scarce resources, the contribution margin will help them focus on those products or services with the highest margin, thereby maximizing profits. Gross margin considers a broader range of expenses than contribution margin. accounting advisory Gross margin encompasses all of the cost of goods sold regardless of if they were a fixed cost or variable cost. For example, they can increase advertising to reach more customers, or they can simply increase the costs of their products.

Contribution Analysis

Therefore, we will try to understand what is contribution margin, the contribution margin ratio, and how to find contribution margin. Given how the CM examines the product-level breakdown of each dollar that comes in and how it contributes to generating profit, the break-even point (BEP) cannot be calculated without determining the CM. Aside from the uses listed above, the contribution margin’s importance also lies in the fact that it is one of the building blocks of break-even analysis. With that all being said, it is quite obvious why it is worth learning the contribution margin formula. It’s important to be aware of these limitations when using contribution margin in business decision-making.

However, this implies that a company has zero variable costs, which is not realistic for most industries. As such, companies should aim to have the highest contribution margin ratio possible, as this gives them a higher likelihood of covering its fixed costs with the money remaining to reach profitability. Recall that Building Blocks of Managerial Accounting explained the characteristics of fixed and variable costs and introduced the basics of cost behavior. The company will use this “margin” to cover fixed expenses and hopefully to provide a profit.

What is a good contribution margin ratio?

Using the provided data above, we can calculate the price per unit by dividing the total product revenue by the number of products sold. On the other hand, the gross margin metric is a profitability measure that is inclusive of all products and services offered by the company. This means that, for every dollar of sales, after the costs that were directly related to the sales were subtracted, 34 cents remained to contribute toward paying for the indirect (fixed) costs and later for profit. While a high contribution margin ratio is impressive, it is important to note that companies should not sacrifice the quality of their product or service purely for the sake of increasing the contribution margin ratio. Striking a balance is essential for keeping investors and customers happy for the long-term success of a business.

It can therefore be said that contribution is the difference between the sale price and variable cost. Although they both concentrate on distinct facets of a company’s financial performance, contribution margin and gross profit margin are financial indicators used to assess a company’s profitability. This formula assumes that variable costs are constant per unit of production. Fixed costs are business expenses that do not change regardless of changes that may occur in production or sales. These costs are independent of the business operations and are often considered sunk costs because they cannot be recovered once spent.

Technically, gross margin is not explicitly required as part of externally presented financial statements. However, external financial statements must presented showing total revenue and the cost of goods sold. Often, externally presented reports will contain gross margin (or at least both categories required to calculate gross margin). Investors and analysts may also attempt to calculate the contribution margin figure for a company’s blockbuster products. For instance, a beverage company may have 15 different products but the bulk of its profits may come from one specific beverage. The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources.

For this section of the exercise, the key takeaway is that the CM requires matching the revenue from the sale of a specific product line, along with coinciding variable costs for that particular product. The analysis of the contribution margin facilitates a more in-depth, granular understanding of a company’s unit economics (and cost structure). However, they will play an important part in calculating the net income formula.

Therefore, it is not advised to continue selling your product if your contribution margin ratio is too low or negative. This is because it would be quite challenging for your business to earn profits over the long-term. So, you should produce those goods that generate a high contribution margin. As a result, a high contribution margin would help you in covering the fixed costs of your business. In effect, the process can be more difficult in comparison to a quick calculation of gross profit and the gross margin using the income statement, yet is worthwhile in terms of deriving product-level insights.

For those organizations that are still labor-intensive, the labor costs tend to be variable costs, since at higher levels of activity there will be a demand for more labor usage. Variable costs are direct and indirect expenses incurred https://www.wave-accounting.net/ by a business from producing and selling goods or services. These costs vary depending on the volume of units produced or services rendered. Variable costs rise as production increases and falls as the volume of output decreases.

Fixed costs are often considered sunk costs that once spent cannot be recovered. These cost components should not be considered while taking decisions about cost analysis or profitability measures. The following are the steps to calculate the contribution margin for your business. And to understand each of the steps, let’s consider the above-mentioned Dobson example. As you can see, the net profit has increased from $1.50 to $6.50 when the packets sold increased from 1000 to 2000.

Gross Margin vs. Contribution Margin Example

The profitability of our company likely benefited from the increased contribution margin per product, as the contribution margin per dollar increased from $0.60 to $0.68. The calculation of the metric is relatively straightforward, as the formula consists of revenue minus variable costs. In particular, the use-case of the CM metric tends to be most practical for companies to set prices on their products and services appropriately to maximize their revenue growth and profitability. Doing this break-even analysis helps FP&A (financial planning & analysis) teams determine the appropriate sale price for a product, the profitability of a product, and the budget allocation for each project.

What is the contribution margin ratio for?

Usually, the products with the higher contribution margin will be allocated more resources because they will produce greater profits than if the same resources were used for the lower contribution margin product. The business might decide to switch to a cheaper supplier for their raw materials or even consider cutting the pay of workers to reduce the labor cost per unit made. Contribution analysis helps compare how individual products are profitable to the company and is easy to use. To resolve bottlenecks, contribution margin can be used to decide which products offered by the business are more profitable and, therefore, more advantageous to produce, given limited resources. For example, consider a soap manufacturer that previously paid $0.50 per bar for packaging.

What is your current financial priority?

This knowledge can be used to drive down fixed costs or increase the contribution margin on product sales, thereby fine-tuning profits. It appears that Beta would do well by emphasizing Line C in its product mix. Moreover, the statement indicates that perhaps prices for line A and line B products are too low. This is information that can’t be gleaned from the regular income statements that an accountant routinely draws up each period. The contribution margin is a financial metric that represents the amount of revenue available to cover fixed costs and contribute to profit after deducting variable costs.

High CM ratios are generally desirable because they indicate that a large portion of each sale contributes to covering fixed costs and profit. However, it is also essential to balance this with the level of fixed costs – a business with high fixed costs will need a higher CM ratio to break even. In this case, the business would have to take a look at its variable costs and see if any changes could be made to cut costs and increase the marginal profit per unit of sale.